Best billing software

Collecting payments from clients and consumers can be difficult. Without an efficient billing system, this can create serious cash flow problems for your business.

Sending paper invoices and collecting checks by mail is an outdated method that does not suit your customers. In addition, it is difficult to manage your receivables and follow-ups in this way.

For service companies, freelancers, and commercial enterprises, invoicing software can simplify your payment collection process. You will get paid faster while offering your customers more convenient payment options.

The best invoicing software is equipped with features such as automated follow-up messages, expense management, receipts, tax information, etc. These tools can simplify your accounting system and facilitate tracking of receivables.

By using an online billing solution, you also add a level of professionalism to your business. You will be able to create professional invoices and provide better service to your clients.

The Top 7 best invoicing and billing software

FreshBooks

Xero

Facture Zoho

Vague

Square

Invoicely

Sunrise par Lendio

After researching and testing dozens of different billing solutions, I have selected seven that I can confidently recommend. Continue below for in-depth reviews containing the features, benefits, pricing, and use cases of each tool on our list.

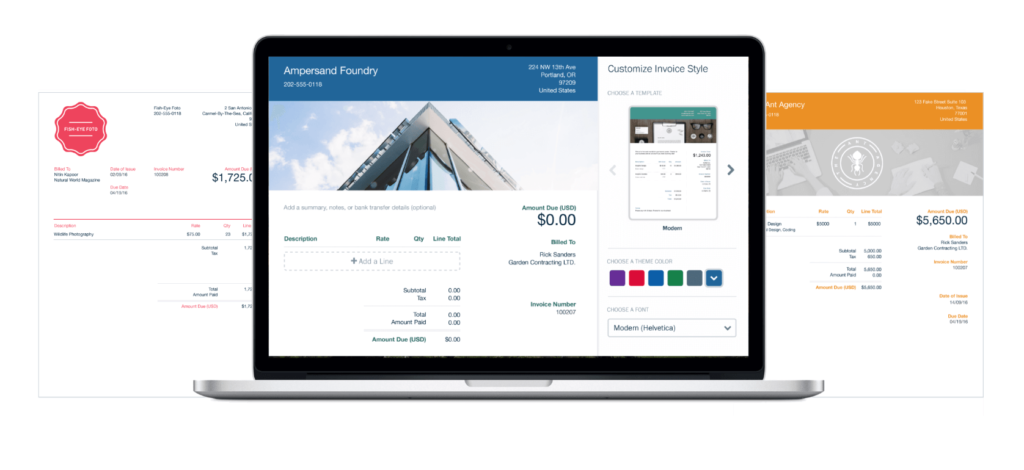

#1 - FreshBooks - The best all-in-one invoicing software

- Starting from 15 dollars

FreshBooks is an all-in-one tool for invoicing and accounting software. It is a top choice tool for small businesses, freelancers, companies, agencies, and consulting firms. This cloud-based software is used by over 24 million people in various industries.

With FreshBooks, it's easy to create a professional invoice in just a few seconds. Simply use the invoice generator to choose a template, add your logo, and customize an email.

FreshBooks also has an integrated payment solution. You can accept credit cards and ACH payments to get paid faster.

You will also benefit from automation features to put your billing system on autopilot. Create recurring invoices, send payment reminders, and automatically bill late fees.

Another important feature of FreshBooks is the ability to collect deposits in the form of a flat amount or a percentage of the total invoice.

Use FreshBooks to customize payment terms, add due dates, automatically calculate taxes, and much more. As an all-in-one accounting solution, you will also have tools for tracking time, expenses, payments, projects, and reports.

FreshBooks has a plan for businesses of all shapes and sizes:

Lite - $15 per month (5 billable clients)

Plus – 25 $ par mois (50 clients facturables)

Prime – 50 $ par mois (500 clients facturables)

Sélectionner – Tarification personnalisée (plus de 500 clients facturables)

For a limited time, FreshBooks is offering 50% off the first three months to new customers. Try it for free for 30 days.

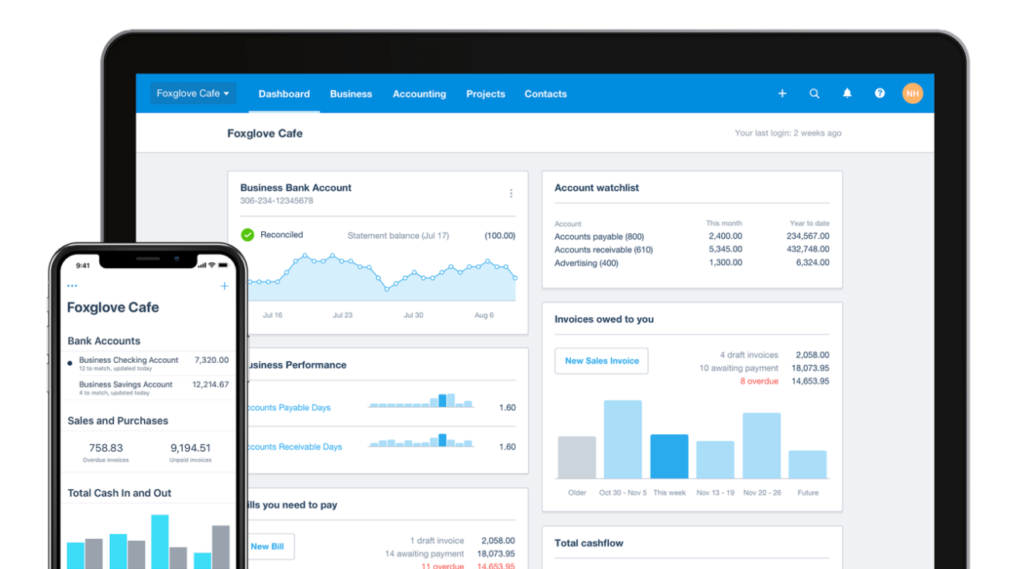

#2 - Xero - The best invoicing software for small businesses

- Starting from 9 dollars

Xero is another all-in-one accounting tool designed for small businesses. As a cloud-based software, it is easy to manage your invoices and finances from anywhere.

Creating professional and personalized invoices is simple. Choose a template, add your brand, upload your logo, and you are ready to send professional invoices to your clients.

With Xero, you will benefit from billing features such as:

Automatically create recurring invoices

Envoyer des factures en vrac

Facturation mobile

Paiements instantanés avec le bouton “Payer maintenant

Frais facturables

Reproduire les factures précédentes

Xero does not have an integrated payment processing tool. However, they work with Stripe and GoCardless for credit, debit, ACH, and digital wallet acceptance. So it is easy to set up and start accepting payments online.

The software integrates with over 800 other applications and tools, including Gusto, Insightly, Expensify, PayPal

Here is a brief overview of Xero's plans and prices

In advance - $9 per month

Croissance – 30 $ par mois

Etabli – 60 $ par mois

The Early plan limits you to only five invoices and quotes per month. Most of you will probably start with the intermediate plan. You can try out all of Xero's features with an unlimited number of users for free for 30 days.

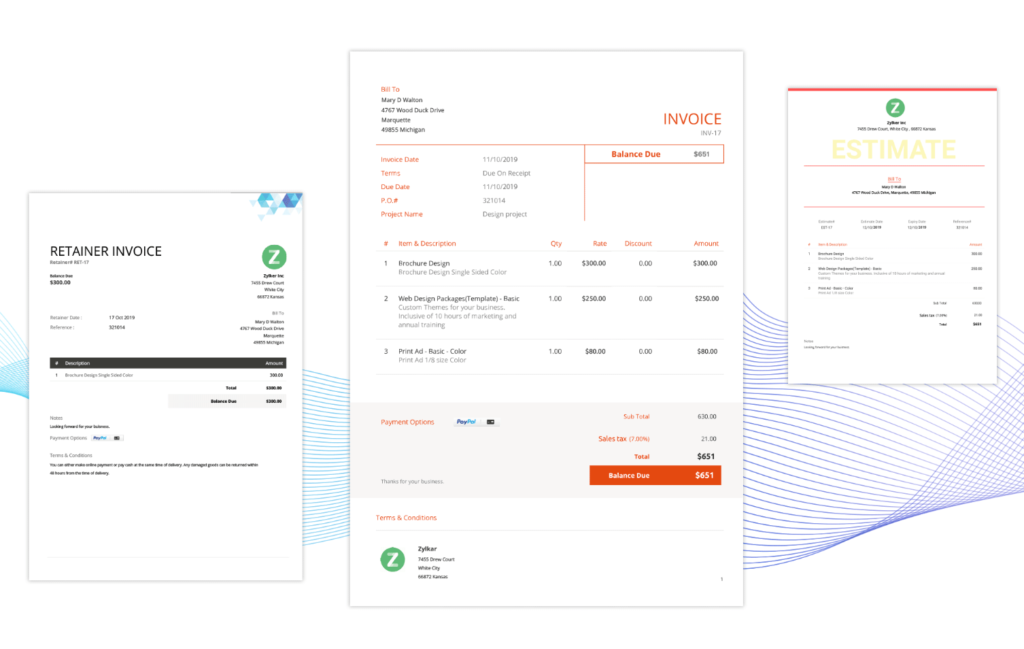

#3 - Zoho Invoice - The best automation features

- Free for 5 clients

Zoho Invoice is a cloud-based software that allows you to create professional invoices, send payment reminders, and get paid quickly online.

Unlike some of the other tools on our list, Zoho Invoice is not an all-in-one accounting solution. But Zoho has everything you need to send and automatically manage your invoices online.

Zoho Invoice offers a complete catalog of invoice templates for different categories, including provisions and quotes. It is easy to create detailed invoices with customized fields while staying organized and demonstrating professionalism.

You will also be able to manage all of your company's tax compliance by indicating the appropriate tax charges on each invoice.

One of the features I love in Zoho Invoice is the recurring billing profile. It is easy to set up automated payments for recurring clients. Zoho even notifies you when clients have viewed an invoice, so you don't have to guess if it has been received.

In addition to basic billing functions, you will benefit from payment management tools, time tracking, and expense tracking. You just need to integrate with your payment gateway to get paid online.

Here is an overview of the plans and pricing of Zoho Invoice:

Free - $0 (billing up to 5 clients maximum)

De base – 9 $ par mois (facturer jusqu’à 50 clients)

Standard – 19 $ par mois (facturer jusqu’à 500 clients par mois)

Professionnel – 29 $ par mois (nombre de clients illimité)

All plans come with free 24/7 assistance and a 30-day money-back guarantee. You can get two free months with an annual plan.

#4 - Wave - The best free invoicing and billing software

- Free and unlimited invoicing

Wave is a 100% free invoicing and billing solution. It is a great option for freelancers, entrepreneurs, and small businesses looking to improve their invoicing processes.

With Wave, you can create and send an unlimited number of invoices to as many clients as you want, and all for free. It is easy to use and the templates are fully customizable.

You can manage your invoices from anywhere with the Wave iOS and Android mobile apps.

Here is a brief overview of Wave's other key billing features:

Invoice in any currency

Envoyer des estimations

Transformer les devis en factures une fois approuvés

Suivi des comptes en souffrance

Rappels automatiques de paiement

Factures récurrentes

Glisser-déposer des postes

Conditions de paiement personnalisées

Calcul automatique des impôts

Suivi des paiements partiels

Voir quand les factures ont été consultées

Aperçu des flux de trésorerie

Accounting tools and receipt scanning are also offered for free.

The only time you will pay is if you use Wave's integrated payment solution, which is billed on a usage basis.

Credit card processing costs 2.9% + $0.30 per transaction for Visa, Mastercard, and Discover. Payments by American Express cost 3.4% + $0.30 per transaction. ACH payments are also available for a fee of 1%.

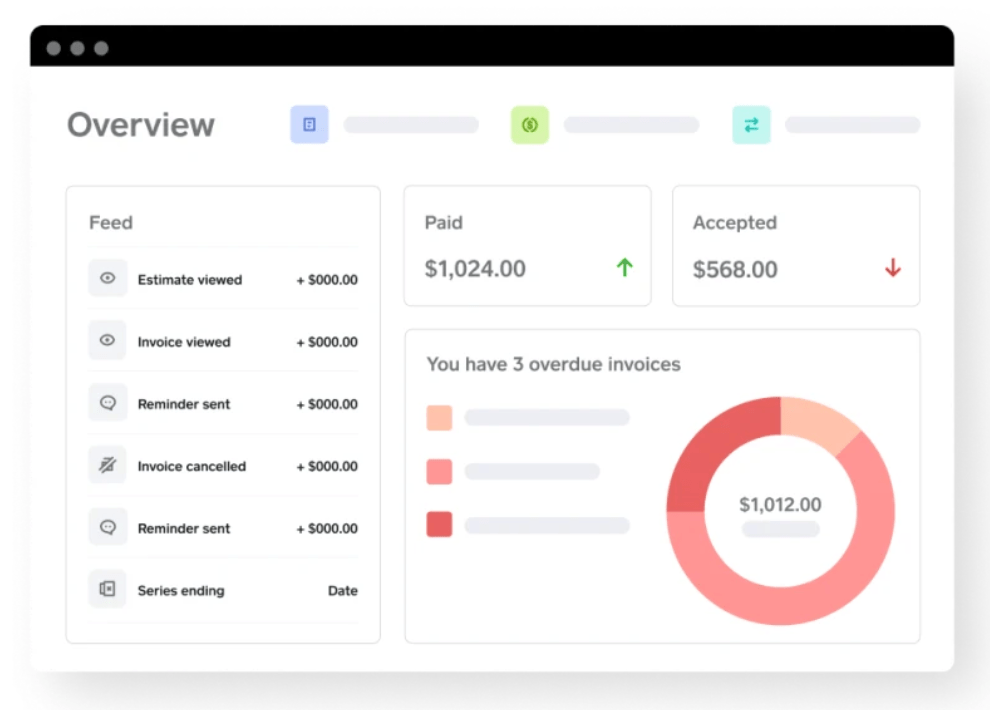

#5 - Square - The best for billing low volumes

- Unlimited free invoices

Square is best known for its point of sale software and payment processing solutions. But it is also a viable option for invoicing and accounting.

With Square, it is easy to send digital invoices to your clients from anywhere online.

More than 100 million invoices have been sent through Square. The platform has facilitated over 20 billion invoice transactions from more than 40 million customers worldwide.

Square allows you to save customer cards in a file for automatic billing and recurring invoices. They also have a wide range of invoice templates for sectors such as customer service, retail, field services, and freelancers.

The main advantage of Square is the integrated payment processing. It is easy for your customers to pay their bills from anywhere in just a few clicks.

There are no monthly fees and you can send an unlimited number of invoices and quotes. You will only pay a processing rate of 2.9% + $0.30 per invoice paid online. This rate increases to 3.5% + $0.15 for transactions by card on file.

These rates are a bit high for payment processing, in general. But it's not a big deal if you don't have a large volume of monthly invoices.

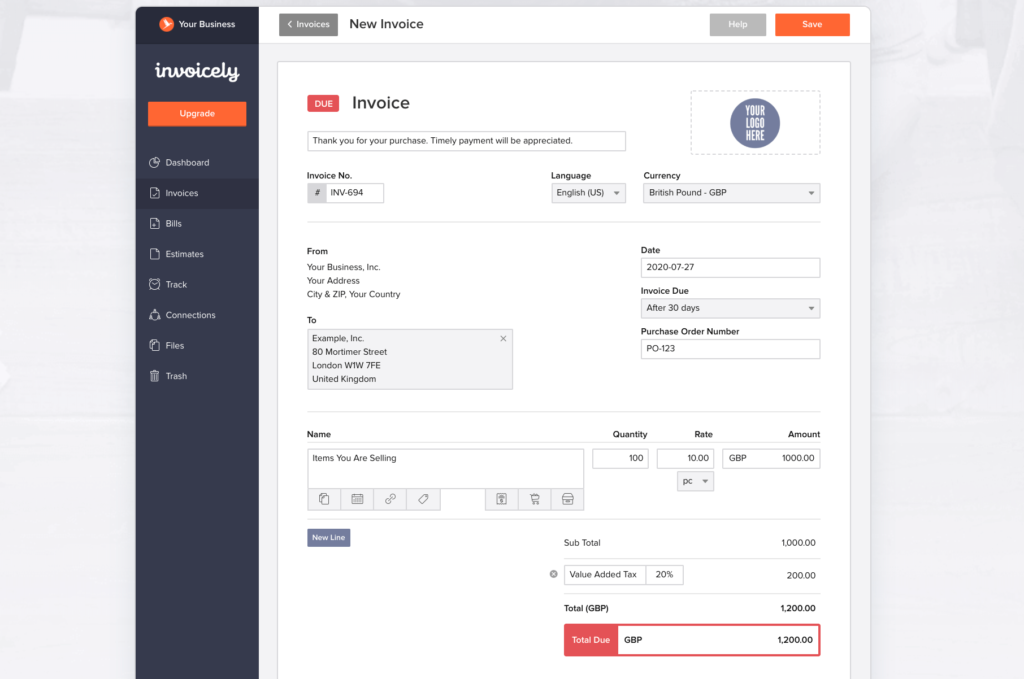

#6 - Invoicing - The best simple invoicing software

- Free for basic use

More than 100,000 companies trust Invoicely. It is a simple solution, making it a popular choice for small businesses.

But do not be fooled by its simplicity; Invoicely is powerful and easy to use. You can create a professional invoice in less than 60 seconds.

The software is not as feature-rich as some of the other solutions on our list. But that being said, it has everything you need to manage basic invoicing.

You will benefit from features such as recurring invoices, the ability to invoice in any currency, send quotes, and accept online payments. Invoicely also has tools for tracking time, miles, and expenses for billing purposes.

There is a free plan available for individual users, but I cannot say that I recommend it. Invoices will bear the Invoicely brand, which is not very professional.

Here is a brief overview of the prices of the paid plans:

Basic - $9.99 per month ($7.99 with an annual contract)

Professionnel – 19,99 $ par mois (15,99 $ avec un contrat annuel)

Entreprise – 29,99 $ par mois (23,99 $ avec contrat annuel)

The plans are largely based on the number of team members you have. Each of them can accommodate up to 2, 10, and 25 users respectively.

If you are looking for an all-in-one accounting solution, Invoicely is not for you. But it is a viable option for simple online invoicing tools.

#7 - Sunrise by Lendio - The best full accounting service

- Free and unlimited invoicing

Sunrise by Lendio is a bit unique compared to other solutions on our list. In addition to basic invoicing and billing, they provide comprehensive accounting services.

It is easy to get started. Simply create an account, sync your bank account, and start sending invoices.

The self-service plan is 100% free. You will benefit from features such as:

Free and unlimited billing

Nombre illimité de transactions bancaires

Rapports sur les flux de trésorerie

Comptabilité en partie double

Recouvrement des paiements

Suivi des dépenses

Estimations et devis

Rapports financiers

Conformité fiscale

The credit card processing fee is 2.9% + $0.30 per transaction, and ACH transfers are 1%.

But for those of you with advanced needs, Sunrise by Lendio has also outsourced accounting services. You will have a dedicated accountant who will record your transactions and close the books each month. You can reach your accountant by phone, SMS, or email.

The pricing of accounting services is based on the number of transactions you make per month.

Early - $149 per month (up to 120 transactions)

Croissance – 299 $ par mois (jusqu’à 200 transactions)

Entreprise – 499 $ par mois (jusqu’à 500 transactions)

If you are not interested in accounting services, you can still use Sunrise by Lendio for free and unlimited invoicing.

How to find the best invoicing software for you

With so many excellent options to choose from, it can be difficult to find the best invoicing and billing software for your business.

But there are certain features you should look for when evaluating different solutions. This is the methodology we used to select the winners on our list. You can also use this methodology to find the software that best suits your needs.

Number of clients

How many clients do you have? How many invoices do you send each month?

Many software programs will limit the number of invoices you can send based on your plan. So it is important to think big here too. What happens if you get new clients? Can you send quotes to potential clients?

Make sure that your software can grow with you as your business expands.

Furthermore, there are certain tools on the market that offer unlimited billing, sometimes for free.

Automation

Billing software should make your life easier. Look for tools with automated features, so you can eliminate manual tasks for optimal efficiency.

Automation is the key to recurring billing. It is also an asset for automated tracking, late fees, payment reminders, and tax calculations.

Payment recovery

Sending invoices is only half the battle. In the end, you still need to get paid.

The best billing and payment solutions have integrated payment processing tools. If these tools are not integrated, you should at least be able to integrate them into a third-party platform.

It is common for some platforms to offer free invoicing tools and only charge you processing fees. Although the fees depend on factors such as the type of card and payment method, they typically start around 2.9% + $0.30 per transaction for credit cards and 1% for ACH acceptance.

These rates are a bit high compared to traditional credit card processing. But it is worth giving your customers a convenient way to pay online. This will significantly reduce the average collection time of your receivables.

Accounting tools

Many invoicing software programs will allow you to do much more than just send invoices. Some are presented as all-in-one accounting solutions. There are even options that offer outsourced accounting services as well.

Among the accounting tools, we can mention expense management, financial reports, receipt downloading, time tracking, bank reconciliation, reports, etc.

But not all businesses need a complete accounting solution to send invoices. If you simply want to send invoices online, save your money and choose a simple software.

Conclusion

What is the best invoicing and billing software on the market today?

We recommend FreshBooks. It is an all-in-one accounting tool. It has everything you need to manage your invoices and get paid online. There are plans and features that can adapt to businesses of different sizes and sectors.

However, there are many viable alternatives to consider.

Xero is our top choice for small businesses. We recommend Zoho Invoice for automation features. For a free invoicing software, try Wave. Square offers integrated payment processing, perfect for invoicing small volumes. Invoicely is ideal for those of you who want a simple solution without extra features. Use Sunrise by Lendio for your billing and accounting services.

Whatever your billing needs may be, you can find a solution with the help of the recommendations in this guide.