Best services for merchants

Service providers to merchants give businesses the ability to process credit card payments.

According to the authorized entity providing services to merchants, these organizations are also known as merchant account providers, acquiring banks, acquirers, credit card processors - or simply processors, in short.

Merchant services come in all shapes and sizes. They can be independent service providers (ISOs), banks, or fully integrated systems for all your hardware, software, and processing needs.

Without the services of merchants, businesses would not be able to accept credit and debit cards. Whether you operate in person, online, or accept payments over the phone, you need to find a merchant services provider to handle your needs.

Whether you are a startup accepting credit cards for the first time or looking for a new merchant services provider as an established company, this guide will steer you in the right direction.

The 10 best services for merchants

Key merchant services

Helcim

Square

Fiserv

Dharma Merchant Services

Marchand de graisse

PaymentCloud

Dépôt de paiement

Rayure

Worldpay de la FIS

After researching dozens of merchant services available on the market today, I have narrowed down the number of options to consider for various use cases. The analyses below present the features, benefits, pricing, and potential drawbacks for each provider on our list.

#1 - Merchant Services - Best merchant services provider

- Accept all major payment methods

More than 25,000 businesses trust Flagship Merchant Services. They offer a wide range of payment processing solutions for accepting payments online, in-store, via mobile phone, and MOTO (mail order and telephone sales).

With our flagship merchant services, your business will be able to accept all major credit card networks and other types of payments such as Apple Pay, Google Pay, etc.

Since 2001, flagship merchant services have been providing exceptional support to businesses across a wide range of sectors.

Companies that open an account with Flagship Merchant Services can benefit from free equipment, such as a Clover mini point of sale terminal or an EMV certified terminal.

This service provider for merchants offers solutions for retailers, restaurants, and e-commerce websites. They promise to beat the total processing cost of any other provider in the market. If they cannot keep this promise, you will receive a $200 AMEX gift card.

In addition to payment processing, Flagship Merchant Services offers cash advances to merchants, digital customer loyalty programs, gift cards, and a business management portal.

Start and request a free quote based on your monthly processing volume.

#2 - Helcim - The best merchant services for small businesses

- $20 per month

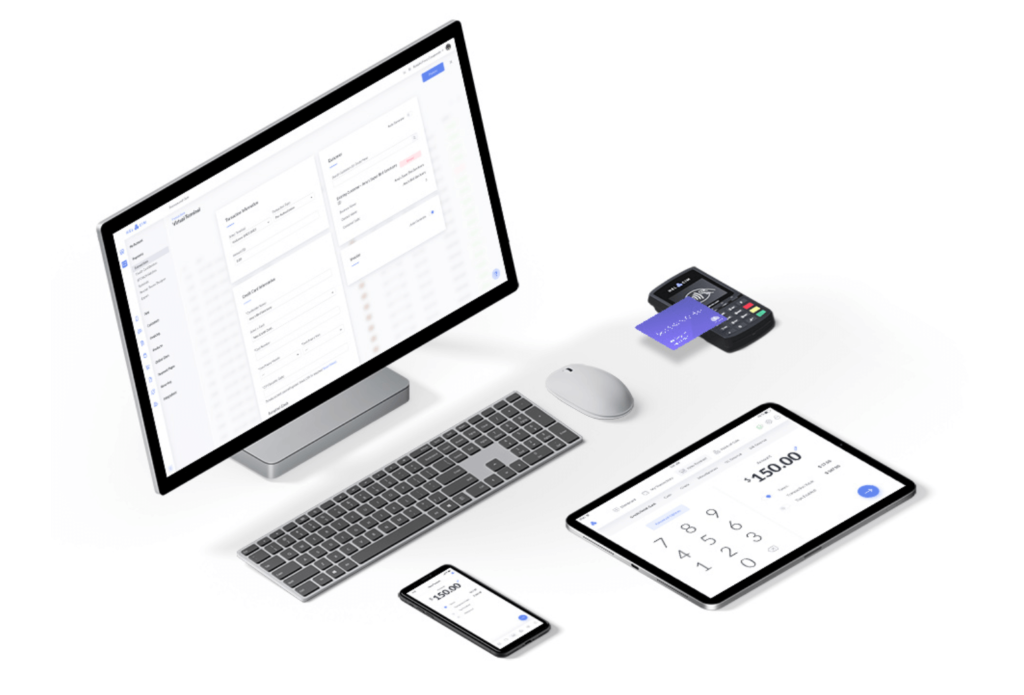

Helcim's merchant services are designed for small businesses. They allow you to easily accept credit and debit cards in person, online, and much more.

Use Helcim's services to set up recurring payments, send invoices, or collect payments over the phone with a Helcim virtual terminal.

Helcim's card readers allow for payments by swipe, dip, tap, and chip. They accept Visa, Mastercard, Discover, Amex, Google Pay, Apple Pay, JCB, etc.

Among the other benefits of Helcim, we can mention deposits within two business days and the ability to securely store credit card information. You can use Helcim's services for payment processing on your computer, smartphone, or tablet.

Sync Helcim directly with QuickBooks Online to simplify your accounting.

Helcim's pricing structure is simple and straightforward. You just need to pay $20 per month to access low interchange-plus rates based on industry, payment method, and monthly volume. Helcim offers volume discounts, no PCI fees, and no long-term contracts

For a limited time, new merchant accounts can get the first six months for free.

#3 - Square - The best for flat rate payment processing

- Free magnetic stripe card reader

Square is one of the most popular merchant services providers in the market today. Millions of businesses trust Square for credit card processing and point of sale solutions.

In addition to physical stores, Square offers online sales services, delivery, contactless payment, remote payment, and even marketing campaigns. Use the Square platform to facilitate curbside pickup, digital invoices, appointments, and customer loyalty programs.

With Square for payment processing, it's easy to get started. You'll benefit from features such as:

No long-term contracts

Pas de frais de résiliation anticipée

Conformité PCI

Pas de frais d’installation

Pas de frais de rétrofacturation

Analyse en temps réel

Lecteur de carte gratuit pour les cartes à bande magnétique

Gestion gratuite des litiges

Outils de prévention de la fraude

As a flat rate operator, you will not pay any additional fees to accept American Express. All your transactions will be processed at the same rate. The only factor affecting the cost is the method of card acceptance (in person or card not present).

In-person sales cost 2.6% + $0.10 per transaction. E-commerce transactions and Square invoice sales cost 2.9% + $0.30 per transaction. Virtual terminal transactions, card on file transactions, and other cardless orders cost 3.5% + $0.15 per transaction.

Although Square is a great option for those of you looking for a fixed rate processor, these rates are likely not the cheapest solution for your business.

#N° 4 - Fiserv - The best services for merchants for retailers

- Solutions for retail points

Fiserv provides financial services technologies to financial institutions, businesses, consumers, and of course, merchants. Formerly known as First Data, Fiserv is the largest merchant acquirer in the world.

The company offers a wide range of services to meet the needs of small businesses, large retailers, and international operations.

Fiserv offers solutions for retailers, service businesses, e-commerce websites, and restaurant companies.

They have numerous point of sale systems for retail merchants, based on your specific needs. From complete countertop stations to flexible card readers that work anywhere in the store, Fiserv has everything you need. You will have the ability to customize your point of sale system with rewards for customers, gift cards, and information.

To get started, contact a Fiserv consultant to discuss your needs.

#5 - Dharma Merchant Services - The best B2B merchant services

- Level 2 & 3 processing

Dharma Merchant Services is one of the few providers in the market offering solutions specifically designed for B2B merchants.

With Dharma, your business can accept level 2 and level 3 corporate credit card data. By processing these types of transactions, you will benefit from lower processing fees. Merchants processing over $100,000 per month can enjoy even lower rates through Dharma's high-volume discounts.

All Dharma merchant accounts are included

Online Reports

Financement le jour suivant (pour les transactions par carte)

Bases de données clients

Stockage des cartes de crédit

Traitement mobile (Apple et Android)

Terminal virtuel

Liens de paiement en ligne

Dharma Merchant Services uses interchange plus pricing for credit card processing. There are no long-term contracts, no hidden fees, and you will receive excellent support from Dharma's technical team.

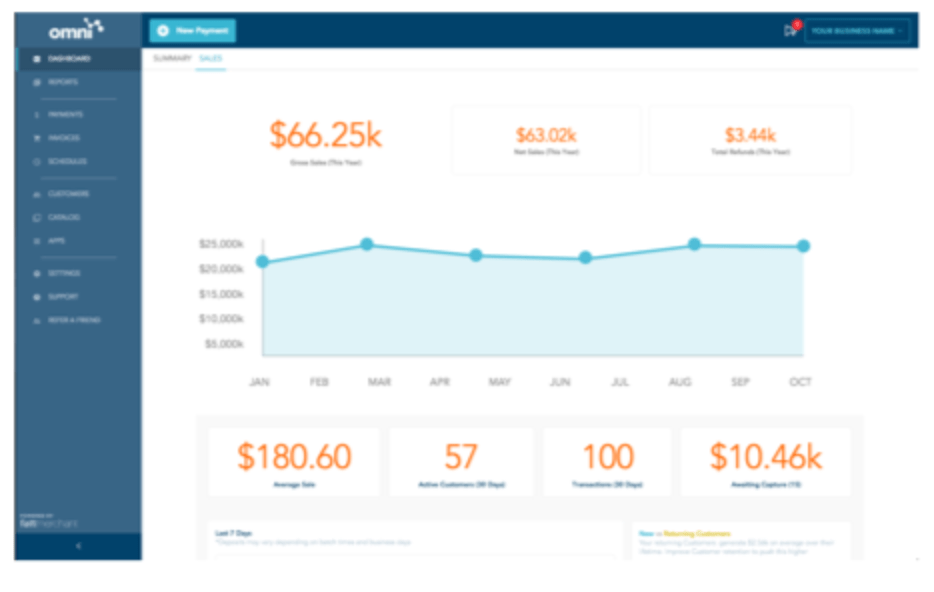

# 6 - The best for low-cost payment processing

- Starting from $99 per month

Fattmerchant works with a wide range of businesses. They have solutions for small businesses, medium businesses, and multi-site businesses.

This service provider for merchants is commonly used by organizations in the retail, professional services, healthcare, food and beverage, and field services sectors.

Although Fattmerchant may not be as popular as some of the other providers on our list, more than 6,000 merchants trust them.

The big merchant provides hosting services

Payments by card

Paiements mobiles

Traitement du commerce électronique

Facturation en ligne

Analyse commerciale

API des développeurs

The subscription-based pricing structure allows merchants to access reduced interchange rates.

Companies processing up to $500,000 per year pay $99 per month and $0.08 + interchange fees per transaction. Companies processing over $500,000 per year pay $199 per month and $0.06 + interchange fees per transaction.

Fattmerchant offers same-day funding, automatic chargeback notifications, terminal protection, and a wide range of hardware options.

# 7 - PaymentCloud - The best for high-risk merchants

- No application fees

Some businesses struggle to find a merchant services provider due to their industry. Some payment processing companies and merchant services do not consider merchants who belong to high-risk categories.

If your application has been rejected by other merchant service providers, you may consider using PaymentCloud. Whether you are processing payments online, in person, or on the go, PaymentCloud has solutions to meet your needs.

PaymentCloud seamlessly integrates

Here are some examples of high-risk sectors that work with PaymentCloud:

Firearms

Logiciels

Entreprises adultes

Tabac

Cigarettes électroniques et vaporisation

Programmes de régime alimentaire

Cautions

Consolidation de la dette

SaaS

Services de rencontres

You just need to fill out an online form, select your terminal or payment gateway, and get ready to process credit cards.

It should be noted that PaymentCloud works with all businesses, including those that are not considered high-risk. However, I would only really consider them for high-risk credit card processing. Other businesses may be able to find better rates elsewhere.

#N° 8 - Payment deposit - the best for processing large volumes

- Transparent pricing

Payment Depot is one of the most reputable and reliable merchant service providers in the current market. It has been called the "Costco of credit card processing".

By paying a monthly subscription, Payment Depot offers low processing rates. This is especially true for high-volume merchants.

Merchants who switch to Payment Depot typically save up to 40% on credit card processing.

Payment Depot offers transparent pricing with no hidden fees. You get free equipment, no contract, and no cancellation fees.

Here is a brief overview of Payment Depot's plans, prices, and processing rates

Basic - $49 per month

0.15 $ + exchange per transaction

Traitez jusqu’à 25 000 $ par mois

The most popular - $79 per month

$0.10 + exchange per transaction

Traitez jusqu’à 75 000 $ par mois

Terminal gratuit

Prime Minister - $99 per month

0.07 $ + exchange per transaction

Traitez jusqu’à 150 000 dollars par mois

Terminal intelligent gratuit ou passerelle premium

Unlimited - $199 per month

0,05 $ + exchange

Traitement illimité

Mini trèfle gratuit et passerelle premium

The processing rates for Payment Depot's unlimited plan are the lowest we have seen in our research. However, it only makes sense for high-volume merchants.

#N° 9 - Striped - The best for online credit card processing

- E-commerce payment processing

For businesses that sell exclusively online, Stripe will be the best merchant services provider to consider. The solution is specially designed for e-commerce websites and online businesses.

Millions of organizations trust it, from startups to Fortune 500 companies and everything in between.

Stripe is a fully integrated payment API that adapts to all products or services that you sell online. It is highly flexible for traditional B2C e-commerce, subscription businesses, and even e-commerce marketplaces.

In addition to processing payments, Stripe offers services to merchants for fraud prevention, billing, and issuing virtual cards. Stripe can also help you obtain funding and manage your business expenses.

Stripe's API is developer-friendly and designed at scale. With Stripe, your payment infrastructure is practically unlimited.

It should be noted that this service provider offers terminals and solutions for in-person processing to merchants. However, I only recommend it to merchants who also sell online, with the online store as their main focus.

#N°10 - Worldpay from FIS - The best for large corporations

- B2C and B2B e-commerce solutions

Worldpay from FIS offers a wide range of service solutions to merchants. They support B2C e-commerce, B2B e-commerce, and omnichannel payment processing.

But above all, the provider specializes in solutions for large companies.

Worldpay from FIS provides innovations and technologies to help businesses grow worldwide. They give you the resources you need to take control of your payment solutions and manage everything from one provider.

In addition to helping with payment processing, this merchant service provider helps you generate more sales and improve your customer service.

They also offer solutions for small businesses, financial institutions, ISOs, software vendors, resellers, etc.

Overall, Worldpay is the best choice for global businesses.

How to find the best services for merchants for you

Some factors need to be considered when evaluating services for potential merchants. The best merchant services provider may not be the best option for you.

This is the methodology I used to choose the winners above. But overall, it depends on your specific needs.

Services

Service providers to merchants provide a wide range of resources to businesses. But they do not all offer the same solutions.

All providers listed on our website offer credit card processing in one form or another. Other services to look for include point-of-sale solutions, hardware, virtual terminals, mobile payments, and e-commerce services. Some merchant services offer business financing, consulting, fraud prevention, customer loyalty solutions, gift cards, billing tools, chargeback management, etc.

Identify your main needs and make sure that the providers you are evaluating can provide these services.

Processing rate

Credit card processing can add up quickly. That's why it's so important to find a cost-effective solution when looking for a merchant services provider.

Flat rate pricing is a viable option for small businesses looking for a simple and straightforward solution. But generally speaking, interchange plus pricing will give you access to the lowest processing rates.

In some cases, you will need to pay a monthly fee to access the lowest rates.

If you have a B2B merchant category code (MCC), look for a provider capable of handling level 2 and 3 card data. This is another way to keep your rates low.

Processing volume

The rates are usually influenced by the amount of money you process per month or per year.

Merchants with high volume will generally have access to the lowest rates. Depending on the merchant services provider, you may need to process between $500,000 per year and $150,000 per month to access these very low rates.

Funding and support

How soon will you have access to your funds after settling transactions? Look for merchant service providers that offer same-day or next-day funding.

You also need to consider the level of support and service you receive. If you have a problem, how quickly can you contact an agent? How quickly will your problem be resolved?

Make sure you fully understand the agreement made with your merchant services provider. The best ones will offer you a free PCI compliance setup and will not charge you for configurations and cancellations.

Conclusion

What is the best option for merchant services? It depends on what you are looking for.

The flagship services for merchants are our top recommendation. But there are many other interesting alternative solutions to consider, depending on your specific situation.

Small businesses and retailers should consider Helcim, Square, and Fiserv. If you want to pay a subscription to access low processing rates, inquire with Fattmerchant or Payment Depot. Businesses should use the services of Dharma Merchant Services. Stripe is the best option for e-commerce sites.

We recommend PaymentCloud for high-risk merchants and WorldPay from FIS for large enterprises.

Whatever your needs may be, you can find the best merchant services for your business by using the recommendations and methodology of this guide.